How to Calculate the Target ROAS for eCommerce Stores

Wondering if your Facebook Ad campaigns are actually bringing in profit?

Or are you running ads with decent ROAS but not seeing the dollars you want roll in?

Maybe you feel revenue rich but profit poor (which is normal and common!)

Running profitable ad campaigns has always been a challenge for eCommerce businesses.

As you scale, new customers get more and more expensive to reach, attract, and convert. Why? Because the larger your audience, the more product-market fit wanes and the faster your ad creative needs to adapt.

So how do you calculate the target ROAS your business should aim for in order to be profitable?

In this post, we’ll walk through the process we follow when determining target ROAS for our clients including:

- How to calculate your ROAS first.

- Defining your eCommerce business costs.

- 3 Steps to help you define and calculate your target ROAS.

- Understanding lifetime value (LTV)

When you know what metrics to track, you’ll ultimately make better decisions with your ad spend to ensure you’re bringing in not just revenue, but actual dollars to your pocket.

Because it’s not the number of clicks that matters, it’s what the ROAS looks like over time.

So let’s dive deeper into how to calculate your target ROAS and to ensure your Facebook Ads are successful.

What is ROAS?

ROAS is short for “return on ad spend.”

In simple terms, it’s the number for how much money is generated on every dollar spent on advertising.

You can use this metric to measure the effectiveness of your marketing efforts or how well a specific ad campaign is doing.

So how do you calculate your ROAS?

Determine the revenue you’ve generated from your campaigns, then divide this number by your ad spend.

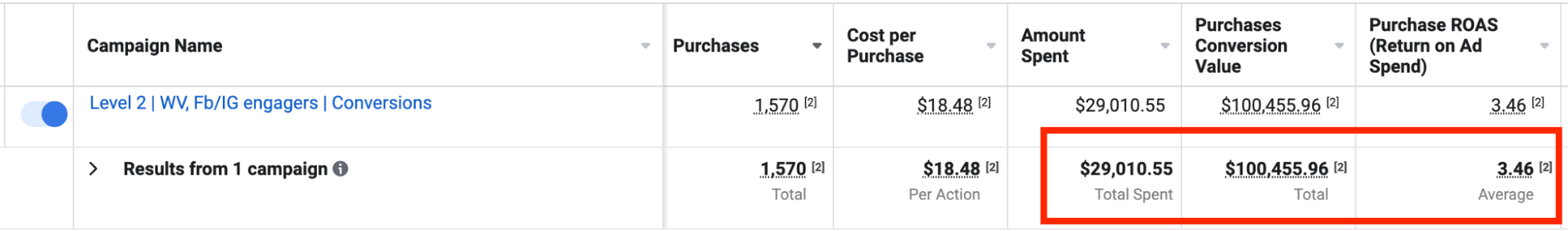

For example, let’s say your business made $100,455.96 worth of revenue in March, and your ad spend for that month was $29,010.55.

Here’s how to calculate your ROAS:

Facebook Ads manager shows ROAS data as a ratio, but some people prefer to calculate ROAS as a percentage.

Using the same example as above, simply multiply your ratio by 100 to get the percentage (i.e. 3.46 x 100).

So in this case the ROAS would be 346%.

Defining the Cost(s)

Before we dive into calculating the target ROAS for your eCommerce business, let’s look at defining the potential costs of your business.

We’ll need this information later to figure out the target ROAS formula.

Typically, all the costs associated with sustaining your business can be segmented into two categories:

Variable costs and fixed costs.

Here’s what each of these mean:

Variable costs are created or directly affected when a sale is made. As the order volume increases, the variable costs (VC) increase too.

Fixed costs are independent of sales and don’t change as volume increases (e.g. operational expenses like rent, utilities, payroll, etc.)

For the sake of defining target ROAS, we’ll use only variable costs since they are correlated with paid media efforts.

Next, let’s look at the most common variable costs for eCommerce businesses.

COGS refers to the production costs per unit. This can be the price you’ve set with a manufacturer or the cost of materials and labor (e.g. for things like handmade or in-house goods).

Sometimes, shipping and receiving will be bundled into your COGS too.

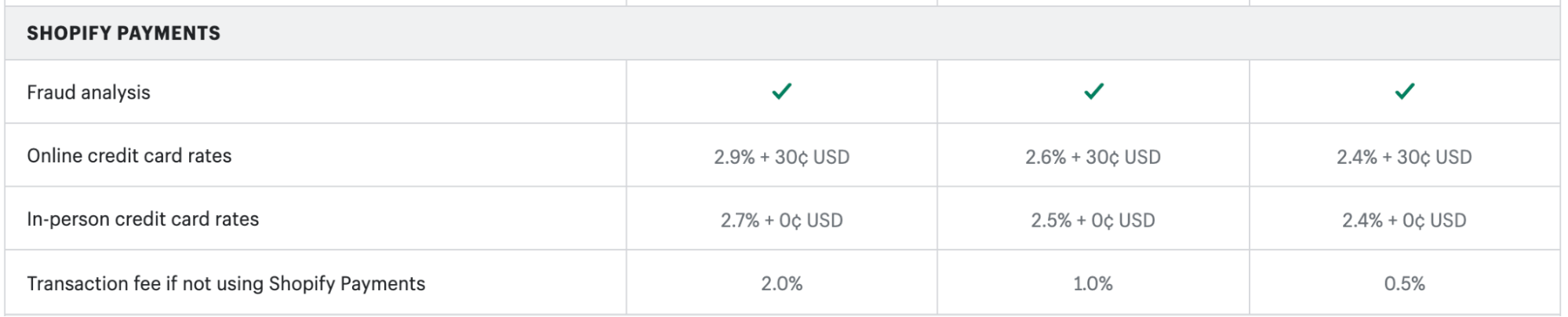

Transaction fees are also known as your payment processor fees.

Along with major credit cards, the most popular payment processors for brands and eCommerce stores are PayPal, Stripe, Square, and Shopify Pay.

Rates across processors are similar and can start at 2.9% + $0.30 per transaction or lower based on the platform or type of plan.

Apps like Klarna and AfterPay also boost conversion rates but may come with additional charges.

After COGS, shipping your product to your customers is the next biggest cost for eCommerce brands and stores.

To help mitigate the cost, some businesses factor the cost of shipping into the price of their products. If this is the case, the amount doesn’t count towards your variable costs.

But if your business pays for the shipping, costs tend to vary depending on the carrier, product weight, and shipping speeds.

In the end, what matters is the average cost of the one item you’re evaluating.

How to Calculate Target ROAS

The key to running or scaling profitable media campaigns?

Defining your target ROAS.

When our AdTribe team connects with a potential client, this is the first metric we find out before moving forward.

We often hear things like, “my target ROAS is 10” or “the higher the ROAS, the better,” and even though we completely understand the desire to get $10 for each $1 spent on ads, for most businesses this isn’t the case.

FB ROAS Benchmarks YTD:

— Taylor Holiday (@TaylorHoliday) June 24, 2021

?Average: 1.52

?Median: 1.3

?Gold Standard: 2.5

FB ROAS Benchmarks L30:

*please watch video*

?Average: 1.04

?Median: .8

?Gold Standard: ?♂️

It’s ugly out there folks pic.twitter.com/XEld2HaEtY

So to help make your life easier, we created a spreadsheet that automatically calculates the target ROAS for your business.

Download the Target ROAS CalculatorNow let’s dive into the three main steps to calculate your target ROAS:

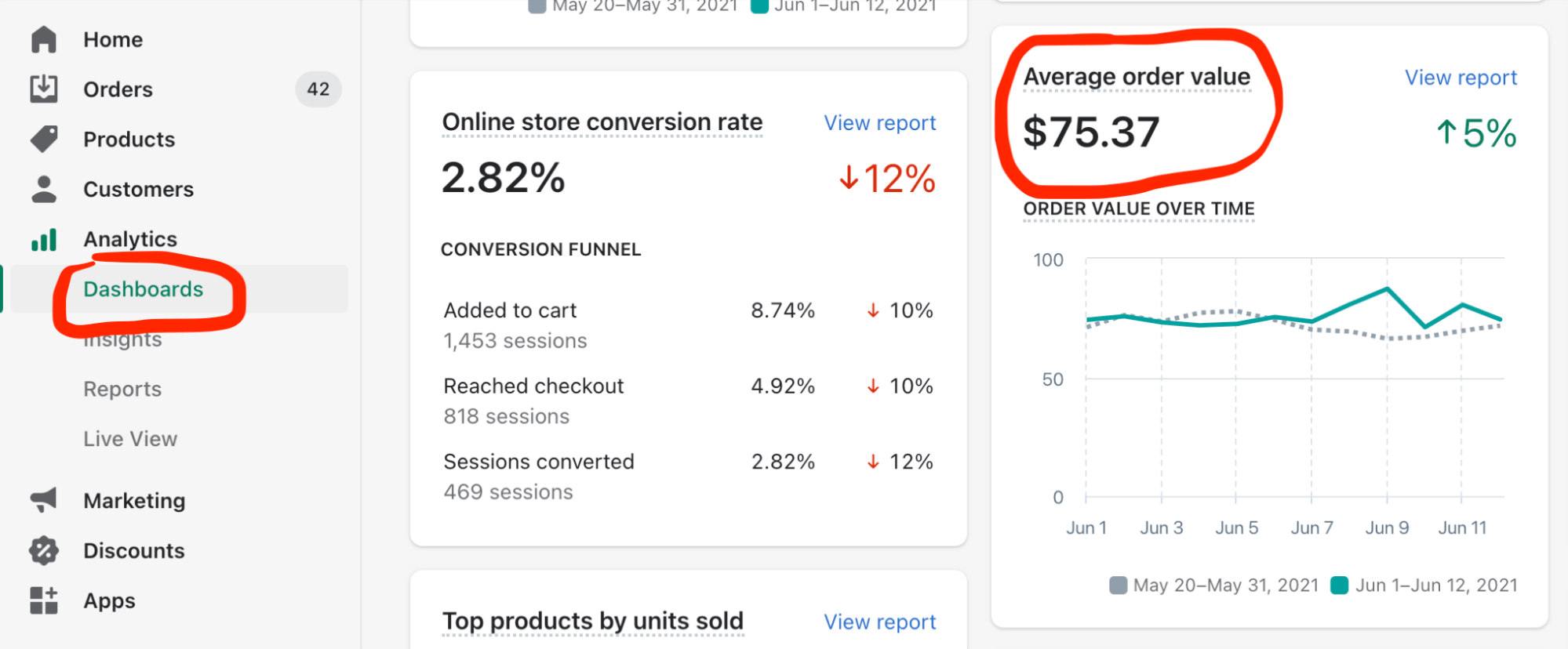

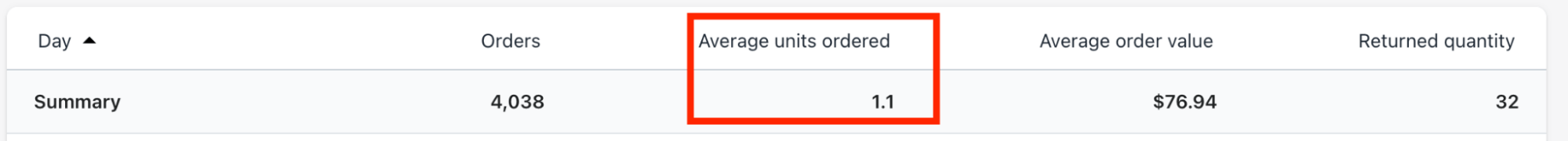

Identify your average order value (AOV) and the average units ordered. If you’re using Shopify, you can find this data in the Analytics section.

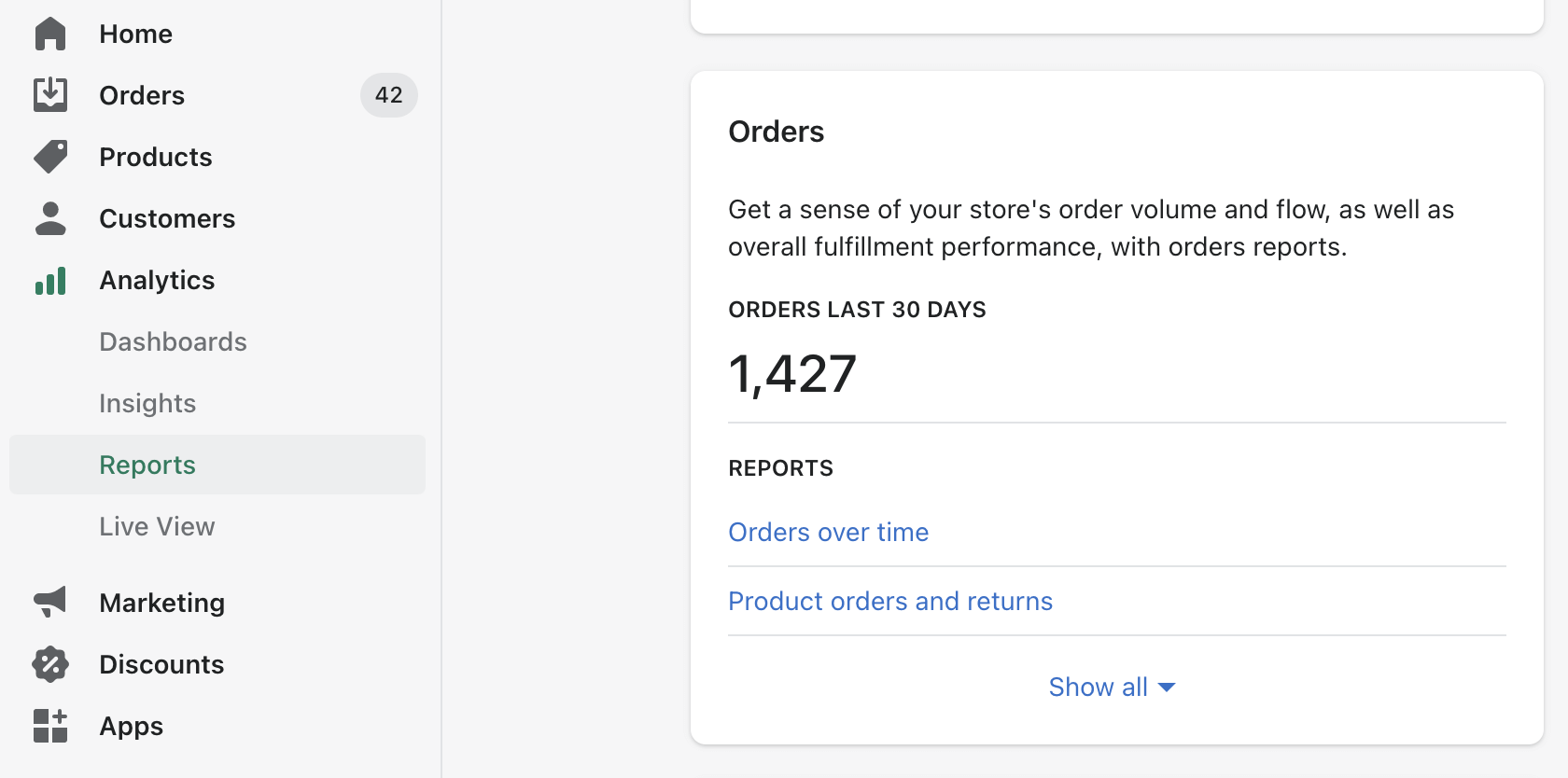

To see the average units ordered on Shopify, go to the Reports section and then Orders.

If you’re using another eCommerce provider, divide the number of units ordered by the total number of orders.

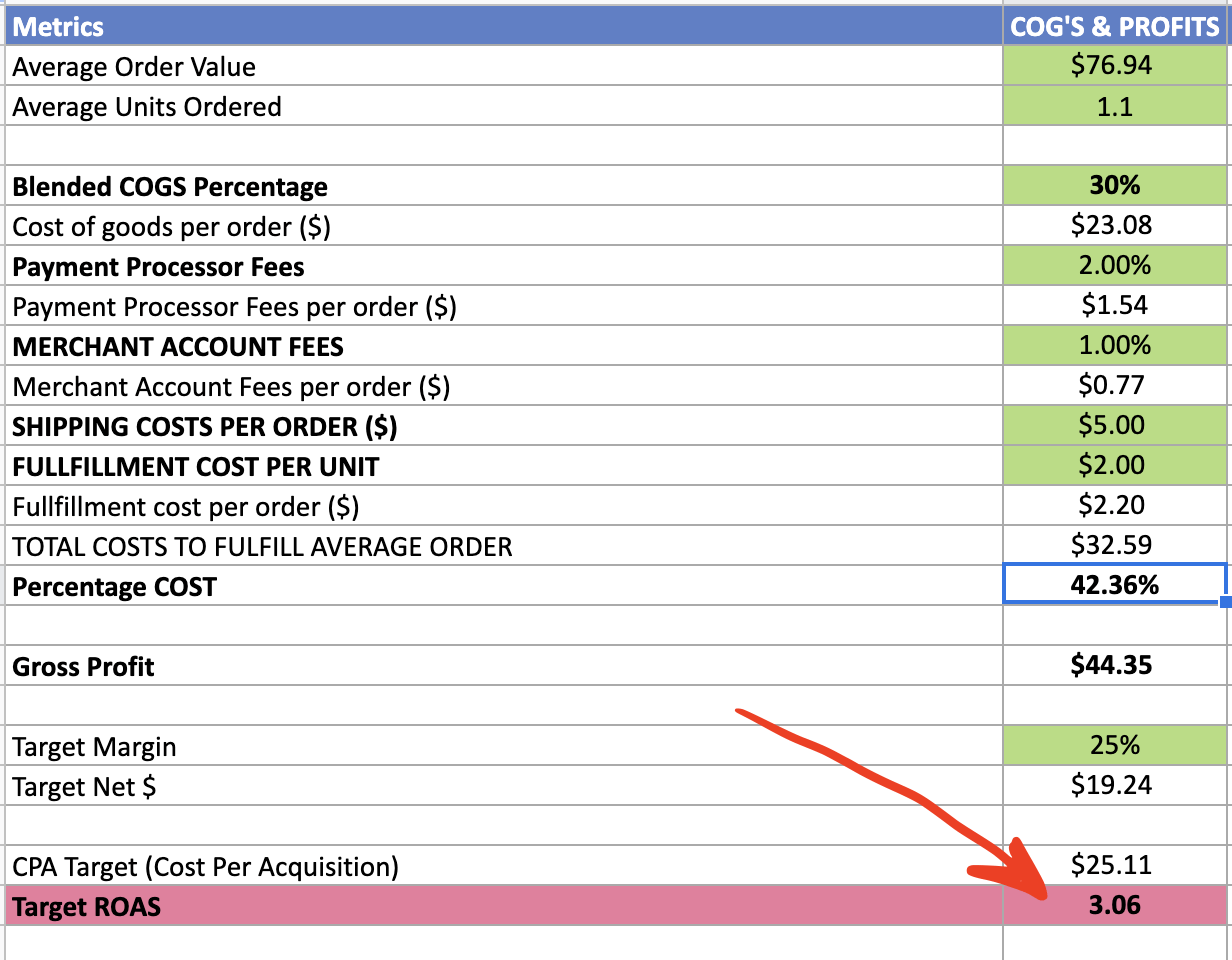

Add up all the expenses related to the product fulfillment like the COGS (blended average), shipping, and payment costs.

Ideally, your total costs to fulfill the average order should be around 25 – 30%. If your number is higher than this, then some changes will need to happen to increase the AOV and reduce the costs.

Define your target margin or how much money you want to make per order. Keep in mind that the lower your target margin (hence your business is better optimized), the lower the target ROAS you need to scale your business efficiently. A good target margin to aim for is 20 – 30%.

After you follow these steps, you should get the target ROAS your business needs to aim for.

A Few Words on Lifetime Value (LTV)

So what if your numbers don’t add up? What if you start to feel like you’re losing money?

The good news is that you could actually be winning with your ad campaigns.

Here’s what we mean:

Let’s say your business sells chocolate chip cookies. Your AOV is $25 and the cost per acquisition is $15, which means you’re probably not making a profit on the first sale.

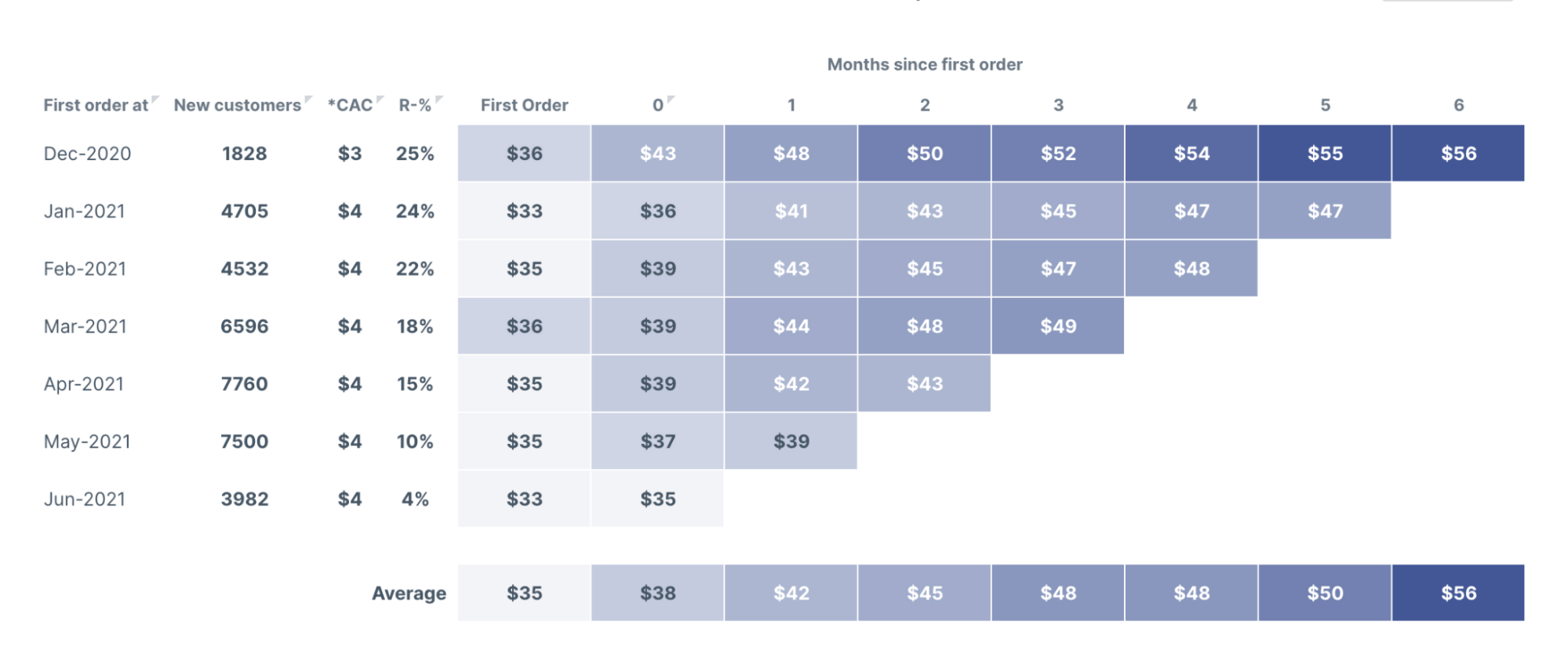

But what happens when you get customers who genuinely love your product and you offer outstanding customer support? They’re way more likely to purchase again and again. And this is where the LTV metric comes into play.

Let’s assume the average customer makes more than one purchase and within the next 60 days, they buy $20 more of your delicious cookies. This means your initial AOV of $25 now increases to $45.

Knowing this number can be a gamechanger for your business since you now have space to scale your budget (which means more dollars in your pocket, of course!)

If you’re using Shopify, the Lifetimely app can track your LTV numbers for you.

And if you’re not using Shopify, you can use this next formula to calculate your LTV:

Here at AdTribe, we usually calculate LTV for 60, 90, and 120 day periods.

An increase in LTV will vary based on the product you sell, but you should have at least a 30% increase in AOV over a 90 day period.

Conclusion

Know your numbers before you spend.

Then you can plan around, and anticipate, your advertising efforts and any rising costs as your customer base expands.

Be sure to download a copy of our Target ROAS Calculator.

If you’d like more support with growing or scaling your ad campaigns, connect with our AdTribe team and let’s start a conversation.

Want to see the ad results we’ve achieved for our clients? Check out the numbers here.